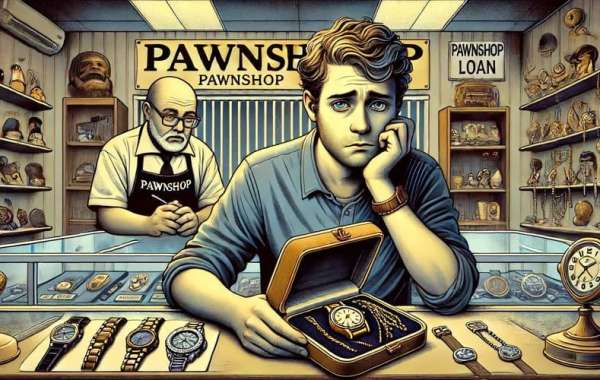

Understanding pawnshop loans could be important for individuals looking for quick cash with out the need for credit score checks or lengthy mortgage processes. This article delves into the intricacies of pawnshop loans, exploring how they work, their advantages, potential drawbacks, and regulatory concerns. As a significant monetary service, pawnshop loans provide a way of acquiring funds in instances of want. Additionally, we will spotlight BePick, a dedicated platform that offers detailed information, reviews, and insights about pawnshop loans, making certain you're well-informed before making any financial selecti

Emergency loans can even help debtors stabilize their monetary situations, allowing them to handle urgent expenses at once. This capability to manage monetary crises successfully can lead to peace of thoughts during annoying times. However, it’s essential to know the implications of borrowing, together with potential debt accumulat

Each state has its personal legal guidelines governing the utmost interest rates 이지론 that might be charged and the required minimal holding periods earlier than a pawned merchandise could be offered. Understanding these regulations might help borrowers make informed selections and defend their rights when partaking with pawnsh

In today’s dynamic real estate market, understanding the ins and outs of actual estate loans is essential for fulfillment whether or not you're a first-time house purchaser, an investor, or just thinking about actual property opportunities. This article goals to demystify real estate loans, outlining the types obtainable, processes concerned, and significant suggestions for securing the best financing. Furthermore, we are going to introduce BePick, a complete platform that offers in-depth information and critiques on real property loans to help you in your journey in the course of informed decision-mak

Next, consider the mortgage phrases, together with the reimbursement interval. Some individuals could favor shorter terms to pay off their money owed quickly, whereas others might favor longer ones for lower month-to-month payments. It's important to find a stability that aligns along with your financial targ

Moreover, the short approval processes often mean less scrutiny, potentially resulting in expensive borrowing decisions. It is important to fully grasp the loan terms, including charges and penalties, before continuing. Navigating these disadvantages is essential to ensuring that borrowing stays a positive step toward monetary

In addition, some borrowers may discover that the structured nature of monthly loans provides a degree of discipline of their monetary management, serving to them keep on track with their general financial objecti

The course of is straightforward, making it a gorgeous possibility for those in pressing need of funds. Unlike traditional bank loans, pawnshop loans don't normally contain credit checks, making them accessible to a broader vary of individuals. However, the interest rates could be greater, reflecting the quick nature of the service and the dangers concerned for the pawns

In most cases, borrowers can repay their month-to-month mortgage early; nevertheless, some lenders may impose prepayment penalties. It's essential to review your mortgage settlement to know the terms relating to early compensation. Paying off a loan early can save on interest costs, making it a beautiful option for many borrow

Resources at Bepick

Bepick is a comprehensive platform aimed at offering customers with detailed data and reviews about month-to-month loans. The web site serves as a useful useful resource for people seeking to navigate the often complex world of borrowing. Visitors can find various articles that break down the several sorts of loans, serving to customers perceive options, terms, and conditi

One crucial facet of monthly loans is understanding the whole cost over the loan term, which is influenced by the Annual Percentage Rate (APR). The APR encompasses not simply the rate of interest but in addition any charges associated with the loan, providing a clearer image of the Mobile Loan's total expe

Women seeking to apply for loans should also prepare necessary paperwork, such as proof of revenue, identification, and an in depth business plan if making use of for a enterprise loan. Understanding these necessities can streamline the application course of and enhance the likelihood of appro

Regularly monitoring funds after borrowing can also be advisable, because it helps avoid missing payments and incurring extra fees. Finally, seeking financial advice can help in developing sustainable strategies for debt management, maintaining a more healthy monetary posture transferring ah

Disadvantages of Emergency Loans

While emergency loans provide many benefits, additionally they include disadvantages that potential borrowers should weigh. One of the primary concerns is the high-interest charges associated with these loans, which may lead to financial pressure if not managed carefully. This is particularly true for payday loans, which might entice debtors in a cycle of debt if they cannot repay the loan promp

-

Главные затраты российского производителя дипломов - авторский обзор

By sonnick84

Главные затраты российского производителя дипломов - авторский обзор

By sonnick84 -

С легкостью покупаем документы в лучшем магазине Russian Diplom

By sonnick84

С легкостью покупаем документы в лучшем магазине Russian Diplom

By sonnick84 -

Где возможно недорого приобрести диплом? Обзор

By sonnick84

Где возможно недорого приобрести диплом? Обзор

By sonnick84 -

Купить диплом – ваш ключ к успешной карьере

By worksale

Купить диплом – ваш ключ к успешной карьере

By worksale -

Купите диплом и забудьте о студенческих трудностях

By worksale

Купите диплом и забудьте о студенческих трудностях

By worksale