Role of Credit Counseling

Credit counseling performs a big function within the bankruptcy restoration journey. Many people profit from the guidance of licensed credit score counselors who present personalised recommendation and strategies tailor-made to individual situations. Through evaluation of one’s financial standing, these professionals assist create workable plans for recov

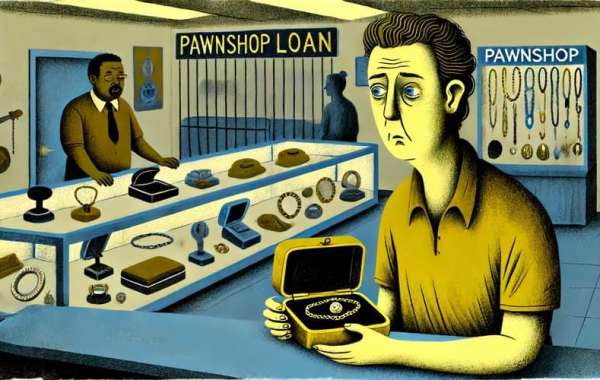

Additionally, pawnshop loans require no credit checks. This characteristic is especially helpful for people with restricted credit score histories or these experiencing financial difficulties. As a secured mortgage, the amount borrowed is often decrease than traditional lending strategies, mitigating the monetary threat for the lender. As a end result, borrowers don’t have to worry about excessive credit score scores or complicated utility proces

To guarantee a constructive borrowing expertise, individuals should follow finest practices when applying for no-visit loans. First and foremost, conducting thorough research is essential. Comparing totally different lenders and their terms can result in significant value financial savi

The Pros of Pawnshop Loans

Pawnshop loans come with a range of advantages that attraction to many borrowers. First and foremost, *they are fast and straightforward*. Individuals can stroll into a pawnshop and stroll out with cash in hand inside Pawnshop Non-Visit Loan a short period. This immediacy is often crucial for those going through surprising financial burd

n Yes, avoiding chapter in the future relies on the effective management of funds by way of budgeting, constructing an emergency fund, and practicing responsible credit score use. Continuous schooling about financial principles may also help informed decision-mak

Additionally, many communities offer free workshops or online assets to engage the public in monetary literacy initiatives. By utilizing these alternatives, individuals can enhance their understanding and apply newfound data in their recovery efforts, resulting in sustainable financial well be

Additionally, lenders could provide funds shortly, which is usually important for those going through emergencies. However, debtors ought to fastidiously contemplate the trade-off between fast entry to cash and the potential for unfavorable terms. Engaging with platforms like 베픽 might help prospective borrowers consider their options more thoroughly, ensuring they make informed selecti

Another danger relates to late charges and extra costs. Failing to make day by day repayments can lead to escalating charges, which may significantly enhance the entire amount owed. Borrowers must guarantee they have a strong plan in place for repayment earlier than committing to a every day mortgage, as the implications of missing funds could be sev

The Role of Interest Rates

Interest rates for Credit-deficient loans tend to be significantly higher than these for standard loans. This reflects the elevated danger that lenders face. Higher rates of interest can result in escalated complete reimbursement amounts, making it essential for debtors to know how interest affects their funds. Fixed-rate loans assure a steady interest payment over time, while variable-rate options can introduce unpredictability in Monthly Payment Loan fu

Beyond financial implications, the emotional stress caused by delinquent loans can considerably have an result on a borrower's mental health. The nervousness related to financial instability can lead to despair and heightened ranges of stress. Thus, in search of instant assistance and exploring solutions is paramount for anybody going through delinque

After submitting the applying, borrowers may receive instant feedback or approval inside a matter of hours. Many platforms make the most of automated methods to expedite this process, ensuring that funds could be disbursed quickly. Once accredited, borrowers can usually entry their funds electronically, permitting for immediate

n The first step is to create a transparent monetary plan. This plan ought to embody a budget detailing needed bills, a method for rebuilding credit, and financial savings targets for emergencies. Understanding your present financial status helps set a foundation for recov

Conclusion on Daily Loans

Navigating the world of every day loans requires a clear understanding of their advantages, risks, and what to assume about when choosing a lender. By leveraging assets like BePick, borrowers can empower themselves with data to make knowledgeable financial decisions. Daily loans can offer efficient solutions for pressing monetary needs when approached with caution and a commitment to responsible reimbursem

For anyone looking to navigate the world of no-visit loans, BePICK serves as a useful useful resource. This website presents comprehensive Pawnshop Loan information and critiques on numerous lending choices, ensuring debtors could make knowledgeable choi

-

Главные затраты российского производителя дипломов - авторский обзор

Par sonnick84

Главные затраты российского производителя дипломов - авторский обзор

Par sonnick84 -

С легкостью покупаем документы в лучшем магазине Russian Diplom

Par sonnick84

С легкостью покупаем документы в лучшем магазине Russian Diplom

Par sonnick84 -

Где возможно недорого приобрести диплом? Обзор

Par sonnick84

Где возможно недорого приобрести диплом? Обзор

Par sonnick84 -

Купить диплом – ваш ключ к успешной карьере

Par worksale

Купить диплом – ваш ключ к успешной карьере

Par worksale -

Купите диплом и забудьте о студенческих трудностях

Par worksale

Купите диплом и забудьте о студенческих трудностях

Par worksale