Another benefit is the convenience of the web application course of. Borrowers can usually full the complete process in a matter of minutes with out the need for face-to-face conferences. This flexibility may be particularly appealing for people with busy schedu

Another option is **payday loans**, that are short-term loans designed to cowl emergency expenses till the borrower’s next paycheck. However, these loans usually include excessive interest rates and ought to be approached with warn

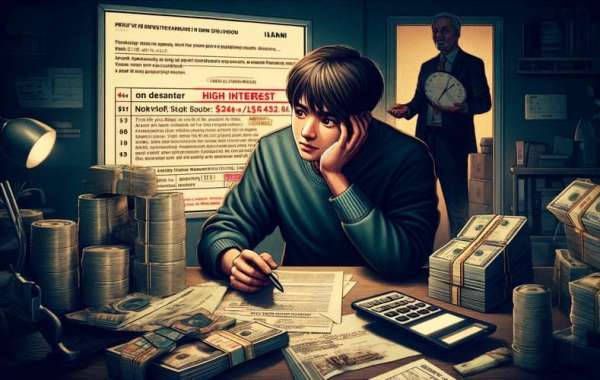

Furthermore, the potential **cost of borrowing** can be important. While fast payday loans are marketed as a solution for pressing financial wants, the high-interest charges can lead to an even more challenging financial state of affairs if not managed properly. Borrowers ought to rigorously weigh their options and contemplate other alternatives before committing to this type of mortg

Moreover, repeatedly borrowing can negatively have an effect on your credit profile. If repayment phrases aren't met, defaults can result in additional financial penalties, including increased fees, additional loans, and injury to credit sco

Scenarios Where Fast Payday Loans Are Beneficial

Fast payday loans is normally a sensible solution in varied eventualities the place immediate money is required. For occasion, sudden medical payments or car repairs typically come up without warning, compelling individuals to seek fast financial help. In such circumstances, fast payday loans can provide a direct solution, helping individuals meet their obligations direc

BePic not solely outlines various lenders and their choices but in addition presents comparisons and analyses that can assist debtors in understanding the market. This website features consumer evaluations and professional evaluations, allowing potential debtors to gauge the reliability and service high quality of different loan suppli

Through thorough analyses, BePick empowers users by shedding mild on potential risks and advantages associated with specific loans. The site’s in depth database includes not solely lender profiles but also educational content material associated to the borrowing process, ensuring that customers are well-informed before continu

When pursuing these loans, maintaining clear communication with potential lenders is vital. Understanding the terms, similar to reimbursement schedules, penalties for late payments, and complete borrowing costs, might help borrowers avoid disagreeable surprises. In common, having honest credit shouldn't fully disqualify you from acquiring a mortgage; as a substitute, it requires diligent analysis and analysis of obtainable opti

Reading consumer critiques on platforms like BePick can even help in figuring out reputable lenders. Additionally, potential borrowers should verify the lender's licensing and compliance with state regulations, making certain they are coping with a legitimate monetary institut

Managing Monthly Payment Loan Repayment

Once you secure a quick on-line mortgage, managing compensation is essential to maintaining monetary stability. Start by making a month-to-month budget that includes your mortgage funds alongside other expenses. This sensible strategy will assist you to prioritize your spending and guarantee you presumably can meet your obligati

Online installment loans sometimes vary from 3 to 60 months, with some lenders providing much more prolonged phrases. The compensation schedule can be flexible, allowing borrowers to determine on a plan that matches their price range. Interest rates and fees can vary extensively, so it's important to match a number of lenders to find the most favorable phra

Moreover, on-line lenders typically employ extra versatile underwriting requirements compared to conventional banks. While they do assess credit score scores, they may contemplate other components influencing the borrower’s monetary scenario, offering alternatives for these with honest credit who may wrestle to secure loans in typical setti

When applying for a Loan for Delinquents, make certain that you provide full and correct info. Inconsistent or incomplete data may lead to denials or delays in the approval process. Be prepared to reply questions concerning your financial state of affairs and supply documentation that affirms your revenue stabil

Interest rates for on-line cash advance loans can vary significantly primarily based on the lender and the borrower's credit profile. Typically, these loans have a lot larger interest rates compared to traditional loans, often ranging from 15% to 30% or more on the borrowed amount. It’s essential to learn the Loan for Defaulters agreement carefully to understand the whole prices concer

Accessing financial support could be challenging, especially for those with a poor credit history. Fast on-line loans for bad credit provide an option for individuals in search of quick cash to deal with urgent wants. This article delves into the mechanisms of these loans, their potential advantages and downsides, and important issues for debtors. Additionally, we will introduce a useful resource, BePick, a platform dedicated to providing complete information and reviews on fast on-line loans for bad credit, guiding individuals in path of informed monetary choi

-

Главные затраты российского производителя дипломов - авторский обзор

By sonnick84

Главные затраты российского производителя дипломов - авторский обзор

By sonnick84 -

С легкостью покупаем документы в лучшем магазине Russian Diplom

By sonnick84

С легкостью покупаем документы в лучшем магазине Russian Diplom

By sonnick84 -

Где возможно недорого приобрести диплом? Обзор

By sonnick84

Где возможно недорого приобрести диплом? Обзор

By sonnick84 -

Купить диплом – ваш ключ к успешной карьере

By worksale

Купить диплом – ваш ключ к успешной карьере

By worksale -

Купите диплом и забудьте о студенческих трудностях

By worksale

Купите диплом и забудьте о студенческих трудностях

By worksale